Oh I didn’t reply to Swim because I thought his post was taking the thread off topic and didn’t want you to jump on my post, but I see you have done what you criticise me for.

No, my reply to the post about the Telegraph linked that news to the Telegraph’s decades long campaign against the EU and support for Brexit with this thread’s very, very frequent posts that are simply copies of newspaper articles. A good number from the Telegraph. Many only loosely linked to Brexit as quite a lot are simply criticism of the EU or EU countries (nothing to do with the UK or Brexit). My post was much more on topic than a lot of posts here. It was bringing a subject back on topic.

Similarly if the earlier discussion about the NHS had segued into staff shortages due to Brexit then that would have moved it back on topic.

Do you see?

What’s the title of this thread?

Ah, so you want every post to have reference back to the benefits of Brexit. Fair enough. But you have a ton of editing to do across the 333 posts you have submitted this far in this thread.

lol I honestly can’t believe the hypocrisy and if you can’t see the hypocrisy in your thinking well!!! lol

No, I don’t want every post to go back to the title of the thread, but I don’t pick others up on it.

Strathmore was full of hypocrisy too, wonder where he’s gone.

I think when you say “hypocrisy” you are trying to say that you disagree. Fair enough.

But my post regarding the Telegraph made specific reference to Brexit. So very much on topic unlike other posts we have seen.

Hi Wendeey.

We will have to disagree on this, not all people can get additional help, and if you had said some people can get it, that would have been fine.

Even with the additional money not everyone can afford a reasonable standard of living, especially those in an older, badly insulated house in a high rent area.

As regards Brexit, I voted leave, I still would, I am most unhappy with the direction of travel of the EU towards further integration.

The EU is effectively run by the Commission, unelected Civil Servants, not elected members, the EU Parliament is just a hot air box which signs things,

This is my genuine view, based on my history of working with them and the arrogant attitude of the unelected careerists in senior positions.

I was also annoyed with our Politicians who could not be bothered with this, more interested in advancing themselves and getting the top job.

As far as I am concerned, we have already had the benefits of Brexit, we have left the EU, no longer part of it.

As for the way we left, the deal we got and our progress since, I think our Politicians have made a right mess of it and have squandered the opportunities Brexit offered.

The figures to June 2023 do not show the full impact of the last few interest rate rises so it’s not representative of the rest of the year. The upbeat change in tone widely publicised is due to revisions to ONS GDP figures going back to 2021 where they have magicked up more GDP through some creative accounting.

If you say so.

the FT says so

If you say so

https://www.ft.com/content/9de96bf8-1ca2-4937-9ef7-44a44d44e0b9

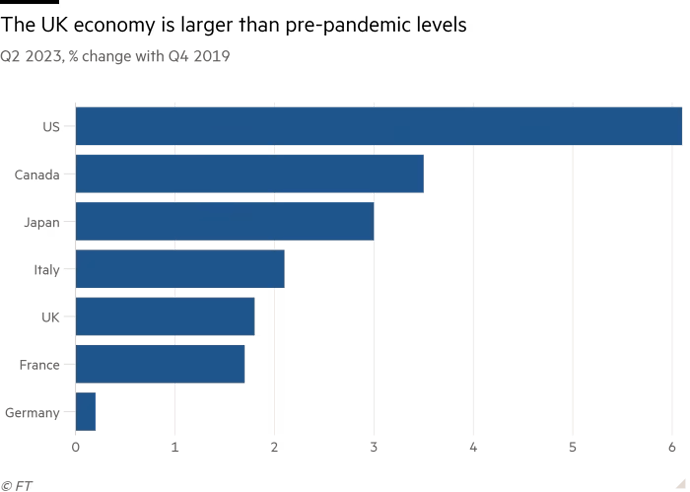

The UK economy has bounced back from the Covid-19 pandemic much faster than previously estimated, according to new official figures that show Britain is no longer the worst performer in the G7. In the three months to June, gross domestic product was 1.8 per cent above its pre-pandemic level in the final three months of 2019, the Office for National Statistics said on Friday. Previously, the statistics agency estimated that GDP in Q2 2023 was 0.2 per cent below its Q4 2019 level. Until relatively recently, the UK was thought to be the only G7 economy not to have returned to pre-pandemic levels. The new figures give Britain a similar performance to France and a stronger rebound than Germany, the eurozone’s largest economy, but its recovery remains weaker than other countries. The bulk of the change came from the large revisions announced at the start of September for the period up to 2021, when the ONS added almost 2 per cent to the size of the UK economy. There were smaller changes for 2022 and the first two quarters of 2023.

Chancellor Jeremy Hunt said: “We know that the British economy recovered faster from the pandemic than anyone previously thought and data out today once again proves the doubters wrong.” “The best way to continue this growth is to stick to our plan to halve inflation this year,” he added. The ONS revisions will have to be taken into account by the Office for Budget Responsibility, the fiscal watchdog, as it prepares forecasts to accompany Hunt’s Autumn Statement on November 22. However, economists pointed out that the UK’s performance was still quite poor relative to other leading economies. Ruth Gregory, economist at the consultancy Capital Economics, said the data did “not change the big picture that the economy has lagged behind all other G7 countries, aside from Germany and France, since the pandemic. And that’s before the full drag from higher interest rates has been felt.” She predicted that higher interest rates — now at 5.25 per cent — would trigger a mild recession involving a 0.5 per cent fall in GDP in the coming quarters. Samuel Tombs, economist at the consultancy Pantheon Macroeconomics, said: “A stable picture might take some time to emerge, given that statistical authorities in other countries are revising their data too.” GDP is now estimated to have increased by 4.3 per cent in 2022, up from previous estimates of 4.1 per cent. Growth between the first and the second quarters of 2023 was left unrevised at 0.2 per cent, but the ONS revised upwards the expansion of output in Q1 to 0.3 per cent from 0.1 per cent, as previously estimated. Friday’s data also showed that household spending grew by 0.5 per cent in the second quarter of 2023, which some economists suggested was a signal that the cost of living crisis is coming to an end. Household disposable income rose by 1.2 per cent in three months to June, supported by a recovery in real wages and the uprating of the value of benefits to take account of last year’s high inflation rate. That helped boost the average percentage of disposable income saved by households to 9.1 per cent in the second quarter, up from 7.9 per cent in the previous three months. Martin Beck, chief economic adviser to the EY ITEM Club, a consultancy, said that while the data showed a much stronger economic recovery in 2021 than earlier estimates, it largely confirmed that the UK had seen negligible economic growth for the past two years. “Sluggishness will characterise activity for the near future,” he said.

Gotta say that graph looks very dodgy. What would be the comparison between Quarter 2 and Quarter 4 in any year? Economic activity varies from Quarter to Quarter in any financial year, for example in Quarter 4 companies are tidying up to put out a good financial report while minimising tax liabilities.

For example do the other countries mentioned have the same financial year as the UK? I don’t know, do you?

If that graph had been comparison between two Q2s or two Q4s then it would have some meaning but as it is it looks like something created to prove a point.

It’s comparing Q2 2023 with the baseline year of Q4 2019, the last economic quarter pre covid where we had normality - It’s the government agency favoured baseline period. The graph wasn’t in my paper version of the FT but it looks familiar. Perhaps they smoothed the data for seasonal variances. I agree it’s wonky accounting otherwise.

Squnadered opportunities is one way to look at it. The other view is that there was never any way to achieve a good outcome from Brexit.

Well take it up with The Financial Times which Annie recommended over The Telegraph as according to her The Telegraph have an agenda where The Financial Times doesn’t.

Why would I do that? I don’t think you have quite grasped the concept of a forum, It’s a place where ideas and views on a particular issue can be exchanged so unless the Financial Times pops in I have no interest in discussing it with them.

Wendeey I didn’t say that. I am not sure where I mentioned the Telegraph but you did post a “comment” article which is an opinion piece. Whereas the FT article is one of their headlines. I don’t have the graph you posted in my paper version so can only take your word for that as I don’t have a subscription and rely on the actual paper. It may be that they have taken information from ONS who supply the figures and turned it into a graph themselves. It doesn’t really matter tbh as it is the wordy bit that I was interested in which confirms that the interest rate hike and subsequent inflation hasn’t been taken into account in this optimistic news. So it’s not if I say so, but the FT says so as mentioned in my post 16 hours ago. Britain is predicted to recover in future, particularly next year onwards, but that of course depends on whether we have any more potty Government changes in economic policy.

Meanwhile Truss is at the Tory conference advising the party of her views.

Andrew Bailey, the Governor of the Bank of England, has left EU Rejoiners in shock after he told a magazine that Brexit has given the UK opportunities.

In an even more surprising move, Bailey, who was a Remainer, admitted that the Project Fear “dire warnings” about Brexit which the Bank of England and other institutions made during the referendum were wrong.

The interview was given to pro-EU magazine Prospect which has opposed Brexit and carried articles making the case for Rejoining the bloc.

Bailey has become the latest top figure to have to conceded that Brexit is proving to be a success despite attempts to claim otherwise.

Mr Bailey said: “I think the post-Brexit landscape does give us opportunities.”

He then went on to admit that EU regulations did not suit the UK.

“You know, I’ve always said, not everything about EU regulation was best-suited to any national circumstances."

And he admitted that claims made during the negotiations after the referendum - about the UK economy crashing because of Brexit and people being poorer as a result - were all wrong.

He said: "If you go back to the period after the referendum, there were pretty dire predictions about the consequences of Brexit for the financial services world, for the City of London. And I think so far those effects have been smaller.”

The words of the Governor will be taken as a warning to Labour leader Sir Keir Starmer who has made it clear that his plan is to tie Britain to EU rules and regulations if he wins power next year.

The Governor’s position, though, is a stark change in the language by the Bank of England which played a significant role in Project Fear on the referendum with institutions such as the International Monetary Fund (IMF) and the Treasury when it was led by former Chancellor George Osborne.

Former Governor Mark Carney joined Mr Osborne in predicting a flight of money from the UK and each household being thousands of pounds worse off as a result of Brexit.

Unlike Germany and France, Britain has not gone into recession.